Tax Rebates For Electric Vehicles 2024 Nc. A new law now offers a tax rebate on some used evs and phevs purchased from dealers. The bill includes $370 billion in investments committed to building a new clean energy economy through a combination of grants, loans, rebates, incentives and other investments.

The ira’s new clean vehicle tax credits are now available and include up to $7,500 per vehicle for new vehicles, up to $4,000 for previously owned. North carolina is not especially friendly to electric cars, at least in terms of incentives and.

A New Law Now Offers A Tax Rebate On Some Used Evs And Phevs Purchased From Dealers.

Ncdot said electric vehicle owners pay about $50 less per year than gas vehicle owners when it comes to total taxes and fees for their cars.

Kentucky Will Impose A Tax Of $0.03 Per Kilowatt Hour On Electric.

The clean vehicle credit added a new requirement for final assembly in north america that took effect on august 17,.

Likewise Wants To Incentivize The Production Of Battery Components.

Images References :

Source: www.carrebate.net

Source: www.carrebate.net

Federal Tax Rebates On Electric Cars 2024, Drivers who purchase and install an electric vehicle charging station can save over $500 with incentive programs. The bill includes $370 billion in investments committed to building a new clean energy economy through a combination of grants, loans, rebates, incentives and other investments.

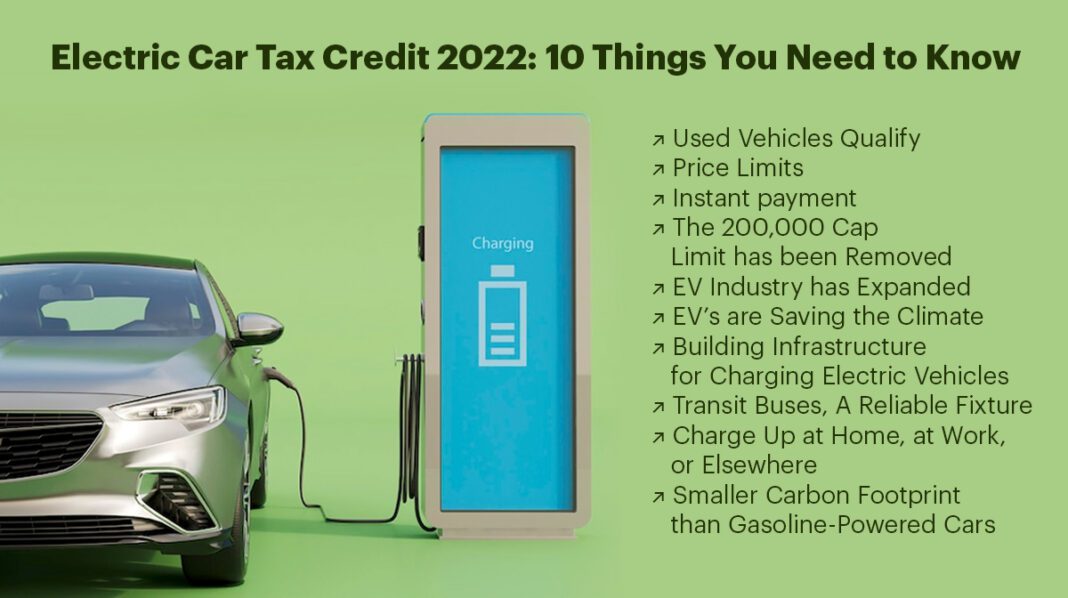

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, New vehicles eligible for the $7,500 tax credit on or after jan. Origin of battery components ($3,750 tax credit) moving back to the assembly side, the u.s.

Source: www.truecar.com

Source: www.truecar.com

How Electric Vehicle Tax Credits and Rebates Work in 2024 TrueCar Blog, File photo of two electric vehicles at a charging station. The ira’s new clean vehicle tax credits are now available and include up to $7,500 per vehicle for new vehicles, up to $4,000 for previously owned.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, Duke energy offers residential customers a $1,133 rebate for electrical upgrades to support a level 2 or direct current fast charging. File photo of two electric vehicles at a charging station.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, Reduced vehicle license tax and carpool lane access. The federal tax credit amount is $7,500;

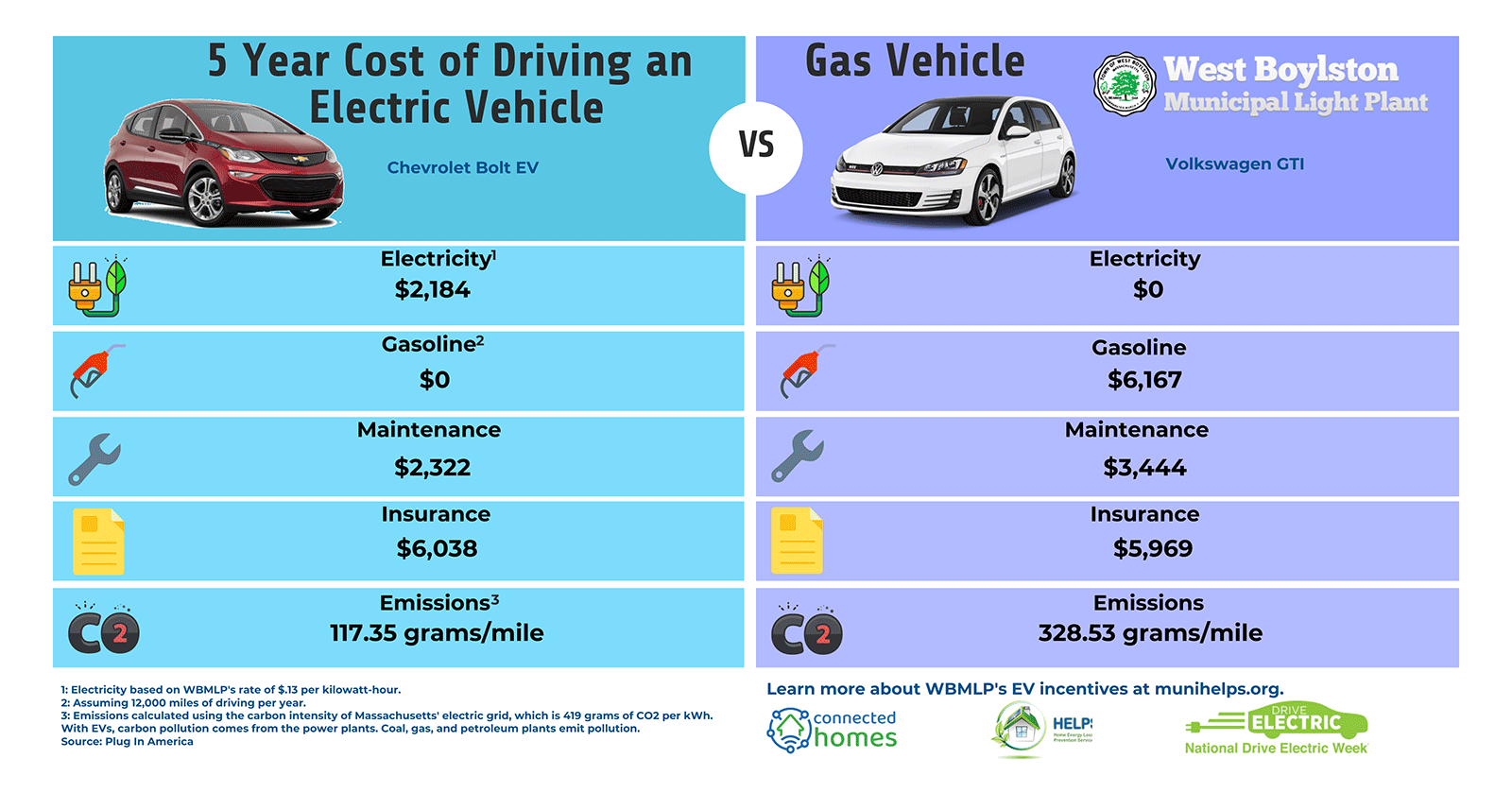

Source: wbmlp.org

Source: wbmlp.org

Electric Vehicle (EV) Incentives & Rebates, The ira’s new clean vehicle tax credits are now available and include up to $7,500 per vehicle for new vehicles, up to $4,000 for previously owned. New vehicles eligible for the $7,500 tax credit on or after jan.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, Ncdot said electric vehicle owners pay about $50 less per year than gas vehicle owners when it comes to total taxes and fees for their cars. In north carolina, drivers of electric vehicles will have to pay a $180 annual registration fee starting jan.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmers Auto, Nevada electric vehicle tax rebates. Federal ev tax credit incentive #3:

Source: avtowow.com

Source: avtowow.com

EV Tax Credits and Rebates List 2022 Guide, Up to $1,000 state tax credit. Origin of battery components ($3,750 tax credit) moving back to the assembly side, the u.s.

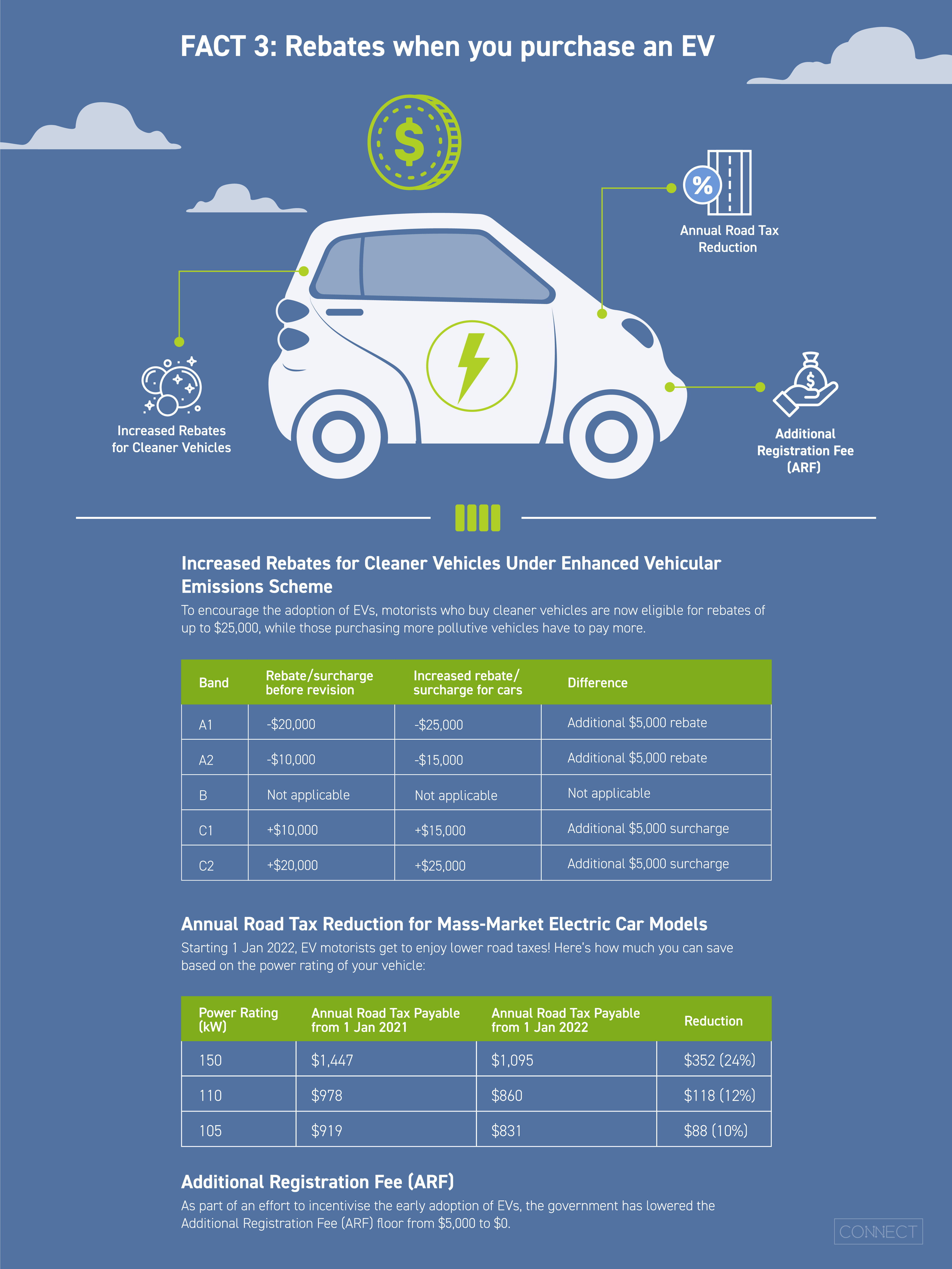

Source: www.lta.gov.sg

Source: www.lta.gov.sg

LTA 8 Facts to Charge Up Your Knowledge About Electric Vehicles, File photo of two electric vehicles at a charging station. Duke energy offers residential customers a $1,133 rebate for electrical upgrades to support a level 2 or direct current fast charging.

New Vehicles Eligible For The $7,500 Tax Credit On Or After Jan.

The bill includes $370 billion in investments committed to building a new clean energy economy through a combination of grants, loans, rebates, incentives and other investments.

The Ira’s New Clean Vehicle Tax Credits Are Now Available And Include Up To $7,500 Per Vehicle For New Vehicles, Up To $4,000 For Previously Owned.

Reduced vehicle license tax and carpool lane access.